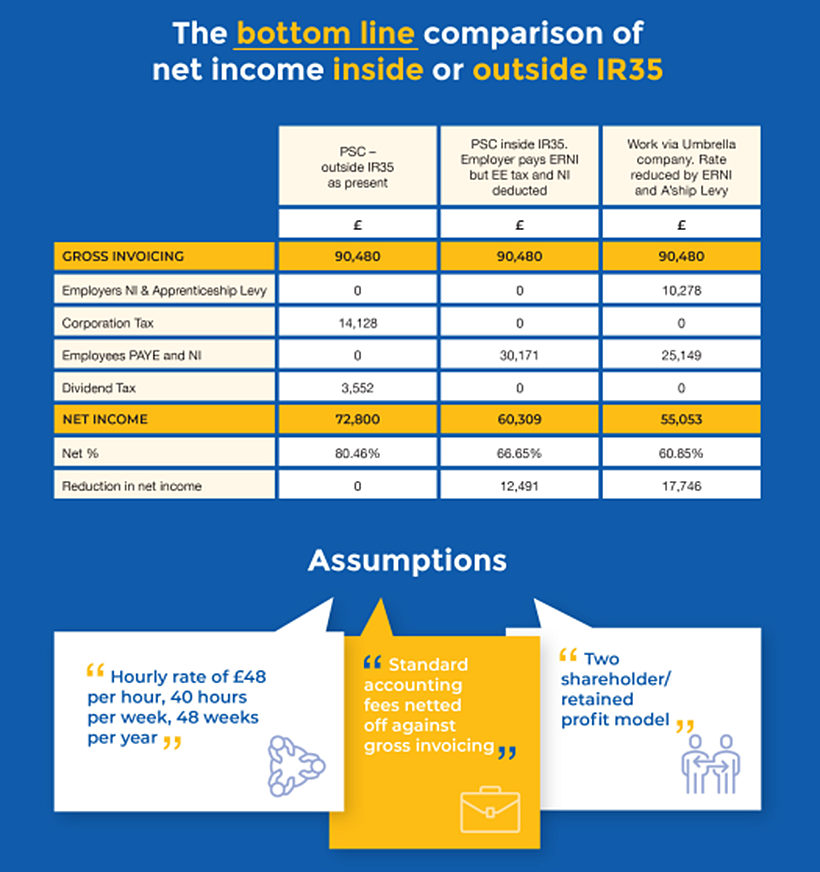

Since 6 April 2021, the off-payroll rules (IR35) have been extended across the private sector bringing large and medium-sized companies under the regulatory framework of the rules.

The introduction of the IR35 legislation means that the engager is now responsible for deciding whether to deduct tax and National Insurance Contribution (NICs) from freelancers and contractors, as if they were employees.

It is estimated that almost a quarter of the UK’s workforce now works on a contingent basis, either in the public or private sector, so this change has affected thousands of workers across the country.

Those who are legitimately contractors should not be affected by this rule change, but different approaches by some engagers means that many have been deemed inside IR35.

Using our considerable expertise in the sector, we can help and advise you should you find yourself inside the IR35 legislation.