After much anticipation, the Government has now published it’s draft legislation for the off-payroll working (IR35) rules, which will be enforced in the private sector from 6 April 2020.

The latest policy document for the private sector shares a number of similarities with that already in force in the public sector.

However, it does introduce a few new changes of which contractors should be aware as they begin to prepare for the changes ahead.

Small businesses exemption

It was already known that the Government intended to introduce some form of exemption for small businesses, but this has now been confirmed in the draft legislation.

This will mean that contractors engaged by a company classed as ‘small’ in a tax year according to the Companies Act 2006 will need to continue operating IR35 as they currently do.

Contractors who are unsure of their client’s classification should ascertain with their client where the responsibility lies as early as possible.

Status Determination Statement’

The new legislation will introduce a new term for hiring organisations to provide IR35 decisions, referred to as a ‘status determination statement’ (SDS).

This statement must be provided by the client to contractors and must include both a decision and the reasoning behind the decision for including the contractor within the IR35 regime.

Where a client fails to do this, it will be seen as a failure by the client to fulfil their obligations, and thus the liability will sit with them until a suitable SDS is submitted to HM Revenue & Customs (HMRC).

This places the responsibility on the client to provide the IR35 determination as quickly as possible to both the contractor and HMRC.

Disagreement process

To reduce the number of client/contractor conflicts, the draft legislation has confirmed that under the rules, clients will have 45 days to consider and respond to any disagreements of a status decision with the reasoning behind their decision.

It is feared that this client-led process will essentially allow some employers to withhold their original decision with no further avenue for redress open to contractors – leading to a rise in employment ultimatums.

This differs drastically from the current system which allows a contractor to challenge the decision via HMRC or through an appeal heard at Alternative Dispute Resolution (ADR) and/or judge at a tribunal hearing.

Under the new client-led system, it will be down to clients with no previous IR35 experience and who may not be an impartial judge to make a decision, which offers little redress to contractors.

How you can prepare

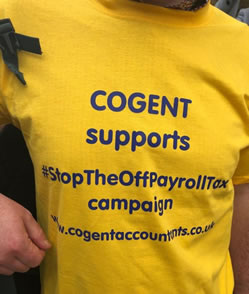

Despite the best efforts of campaigners, including our team at Cogent, it seems likely that the IR35 legislation with go ahead in the form outlined above next year.

With this being the case, it is important that contractors take the following steps to help them prepare:

- Discuss IR35 with your client – it is important that contractors open up a clear avenue of conversation with their client to see if they are aware of the new rules and how they intend to apply them next year.

- Know your rights – Take time to learn about the various obligations your client faces and the rules that are in place to protect your work and self-employed status.

- Build a portfolio of evidence – If you are concerned about a blanket approach to IR35 or you think you may have to challenge a determination in future then it might be worth collecting evidence for your current status so that it can correctly challenged at a later date

If you are struggling to get to grips with IR35 and would like to discuss your circumstance, why not speak to our team today.

Victor Korman, founder of Cogent, explained why they had come to Westminster: “At first sight, tax is not emotive. However, with this new tax, the Treasury and HMRC are determined to destroy this highly skilled and flexible workforce at a time when the UK can least afford to lose a resource that has helped UK business to be world leaders in IT and Engineering. This is something everyone should care about.

Victor Korman, founder of Cogent, explained why they had come to Westminster: “At first sight, tax is not emotive. However, with this new tax, the Treasury and HMRC are determined to destroy this highly skilled and flexible workforce at a time when the UK can least afford to lose a resource that has helped UK business to be world leaders in IT and Engineering. This is something everyone should care about.